I trade in Options only to hedge my positions. However there are traders who trade only options and make huge profit out of them. Unfortunately, very few have the knowledge on how to trade options in India and in most of the cases they end up loosing their entire capital.

In this step by step guide on options trading in India, I am going to explain basics of options for beginners and process of trading them.

I am not going to use the complex terms like “Obligation” and “Exercise” etc which are regularly used while explaining the options since they will complicate the topic. We can understand the concepts better with an example in trader’s prospective rather than knowing the definition of Options.

But for the completeness of this tutorial on options, let us check what is the definition of Options.

What is Options Trading In India – Definition

According to Wikipedia, Options trading is defined as –

” An option is a contract which conveys its owner, the holder, the right, but not the obligation, to buy or sell an underlying asset or instrument at a specified strike price prior to or on a specified date, by paying a premium depending on the form of the option.”

Here it is important to pay attention to two terms “Strike price” and “Premium”.

It is better understood by taking an example,

Options Trading Example

Now let us understand the concept of Options with an example.

On 11th of December 2020 Nifty is trading around 13500.

Suppose Mr.Ravi is very bullish on Nifty and his analysis says that by 31st December it will cross 14500.

How can he implement his analysis into trade? What are the different choices he has?

He can buy Nifty Futures at 13500 and exit at 14500 pocketing 1000 points gain. But he is worried about any overnight bad news that may affect the market sentiment that may result in gap down opening of Nifty and further down move.

In this scenario, Ravi can make use of segment called Options. How? let us understand.

Ravi can buy Nifty Call option of Strike price 13500 at premium of Rs200.

With Call Options, Ravi will gain the difference between closing price on 31st December and 13500 (which is strike price). offcourse we need to deduct 200 which he paid while buying the options.

Now lets check various scenarios of Nifty closing and how it will affect the profitability of Ravi’s trade.

On 31st Dec, if nifty closes at 14500 then Ravi will have

= (14500-13500) – 200 = 800 points profit

On 31st Dec, if nifty closes at 14000 then Ravi will have

= (14000-13500) – 200 = 300 points profit

On 31st Dec, if nifty closes at 13700 then Ravi will have

= (13700-13500) – 200 = 0 points (Break even)

On 31st Dec, if nifty closes at 13600 then Ravi will have

= (13600-13500) – 200 = 100 points Loss

On 31st Dec, if nifty closes at 13500 then Ravi will have

= (13500-13500) – 200 = 200 points Loss

On 31st Dec, if nifty closes at 13000 then Ravi will have

= 200 points loss

As you see, for any close below 13500, Ravi will loose only 200 points which is the premium he paid.

Hence breakeven point is 13700. As long as Nifty closes above 13700 on 31st December, Ravi will be in profit

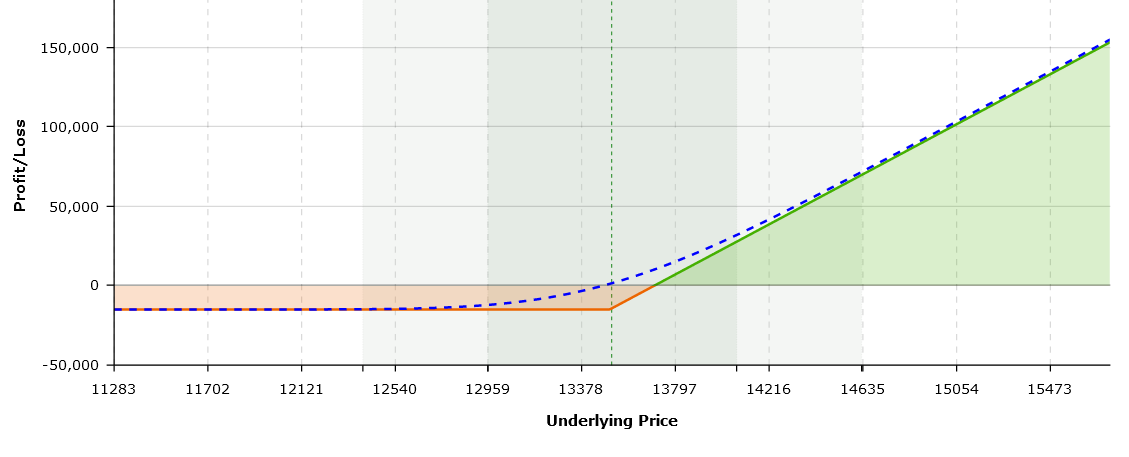

So the payout graph of this particular options trade looks like

With this Ravi has ensured that maximum loss the trade will have is 200 points which is the premium he paid. This downside protection was not possible had he taken the trade in futures segment. Offcourse, he would have gained 200 points more in futures if the trade went as per his analysis.

As you can see, Ravi is entitled to have unlimited profit if he is right and finite loss if his analysis goes wrong. It is just like buying the insurance by paying the premium.

Similarly, one can bet on the analysis that market will go down by certain date. This is achieved by buying the put options. Put Options buyer will be in profit if the underlying closes below his (strike price – premium paid)

So, an Options buyer will buy

- Call Options – if he is bullish

- Put Options – if he is bearish

He can also choose to buy combination of both Call and Put Options and those are advanced statergies known as Straddles and Strangles which I will cover in another post.

How To Trade Options In India?

Now as you have understood the basics of Options, let me explain you how to trade options in India in step by step manner.

Step 1 – Open An Options Trading Account

The first step involved in trading options in India is to open an options trading account.

There are multiple brokers available in India who offer trading account. But I recommend to open account with Zerodha for various reasons.

- Biggest stock broker of India (hence trust factor)

- Neat and clutter free interface

- Lowest brokerage of Rs 20/trade

- Instant and completely online account opening

I am also trading with Zerodha since 2012 and pretty satisfied with their service. I have written detailed review of Zerodha and their offering in this post.

What I like the most about Zerodha is the their trading platform KITE. It is considered as one of the best trading app of India. it allows me to focus on my trade as it is minimalistic and clutter free.

Zerodha Account Opening Charges:

- Online through Aadhaar : Rs 200

- Offline by submitting forms : Rs 400

Account in Zerodha can be opened within 15 minutes if your mobile is linked to your Aadhar number. Check out detailed Step by step procedure on how to open Zerodha account with screen shots.

SaveRs200: you can save Rs200 by opening the account online. Use below Link to save Rs 200.

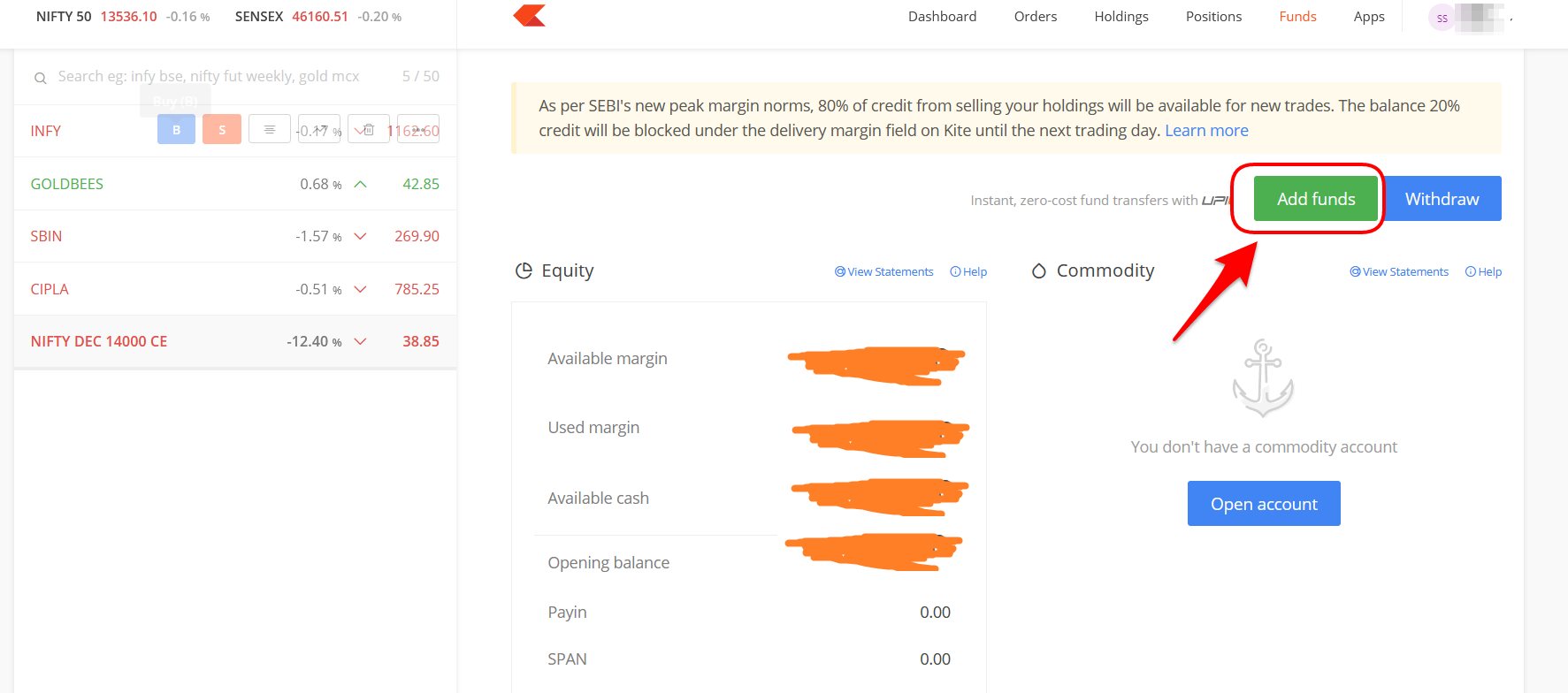

Step 2 – Add Funds To Your Options Trading Account

Once the account is open and activated, next step is to add the required amount to trading account by transferring the funds from your linked bank account to trading account.

Login to Zerodha Kite using the username and password. Use “Funds” menu, click on the add funds. You can add the funds using the internet banking.

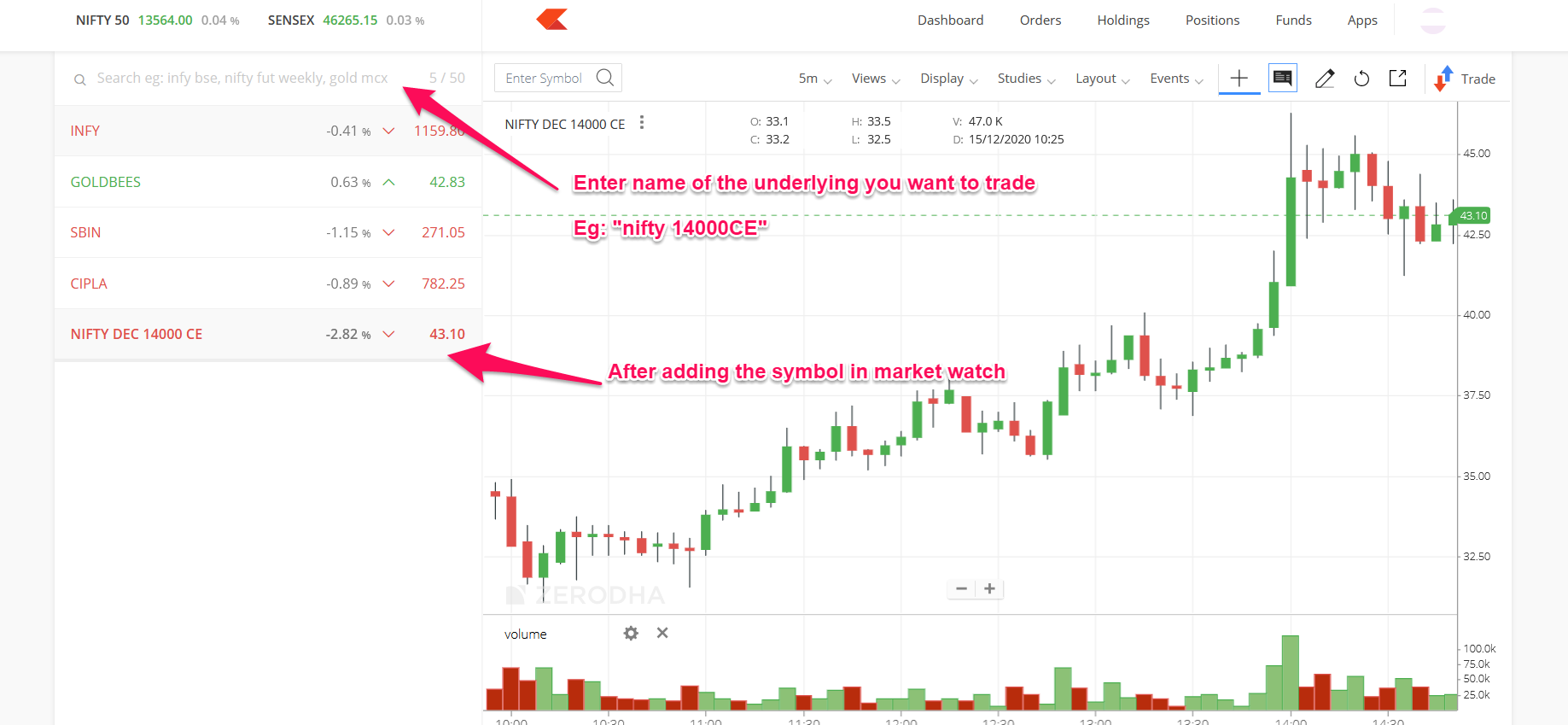

Step 3 – Add Symbol In Market Watch

Add the underlying that you want to trade to the market watch using the Universal search menu.

For example, if you intend to buy Nifty 14000 call options, type nifty 14000 CE and then select the appropriate expiry date that you want to trade.

In below image, I have added the Nifty 14000CE options for December expiry.

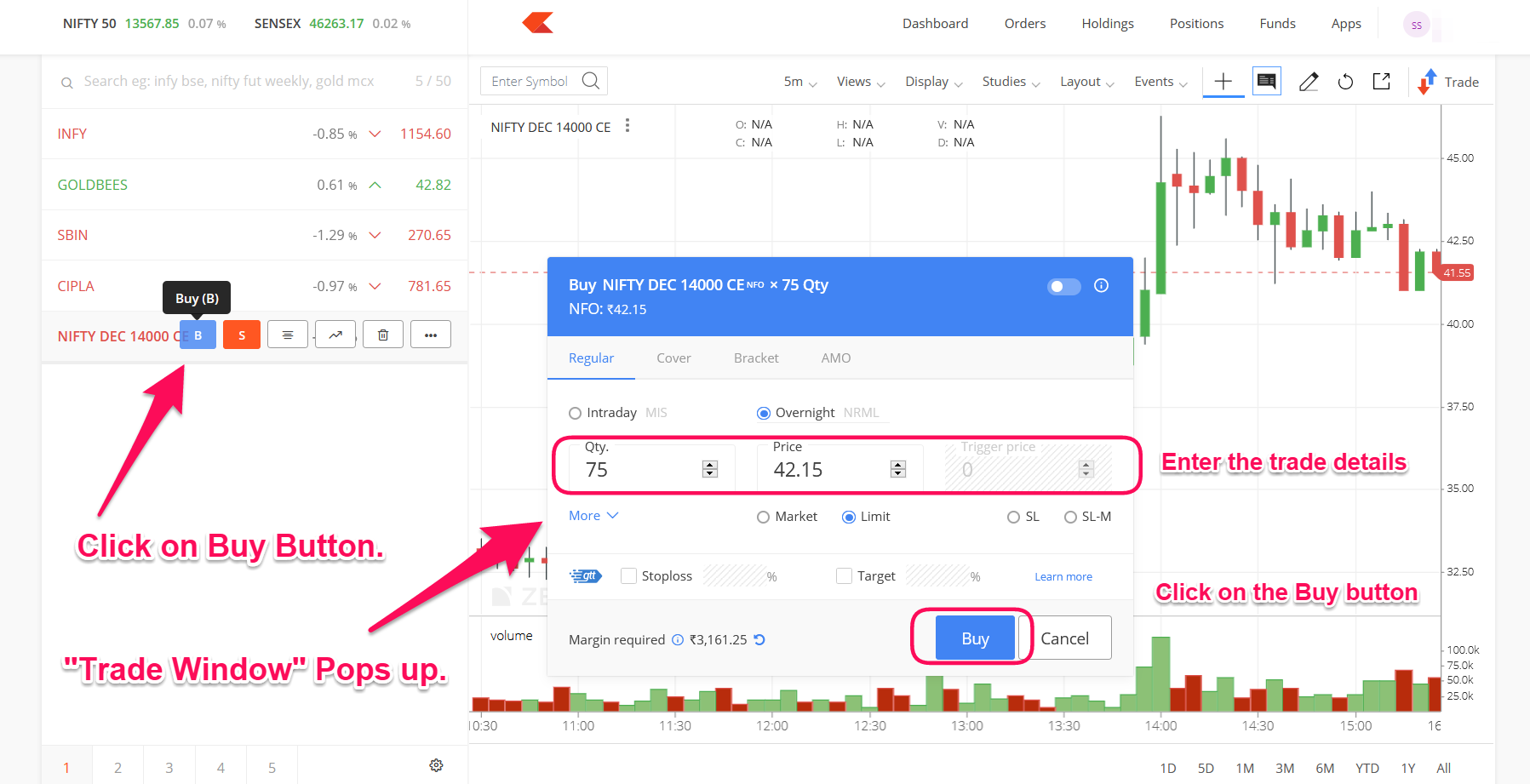

Step 4 – Enter The Trade Details

Now click on the “Buy” button , another window pops out.

In this window you need to enter your trade details. Please pay attention to quantity and the price. Also here we are choosing overnight radio button as we are taking view for 31st December.

You can also trade options for intraday just like it is done in cash market.

Please note, Options are traded in lots. One lot consist of predifined set of shares. For example, nifty consist of 75 shares.

So to buy one lot of nifty at 42.15, you need to have ( 75 x Rs 42.15 = Rs 3161.25) in your trading account..

Now it also possible to sell first and buy later. This is called Options selling or Option Writing.

Options selling involves higher risk and hence not advised for beginners. Also the margin required for options writing is high as it involves unlimited risk (atleast theoretically).

Step 5 – Monitor The Trade

Now you have entered the trade. You can monitor the trade by visiting the “Positions” menu.

You can either choose to wait until the expiry date when the Options are expired automatically and the profit (if any as per the explanation I provided in the earlier section) are credited to you account.

Or, you can also exit the trade anytime before the expiry date by squaring off the Open position if you wish based on your latest analysis.

Options Trading for Beginners – Tips

As beginners, Options traders tend to make lot of mistakes. I am listing down some pointers and tips which will help you in becoming a good Options trader in India.

#1 Never Forget Time Decay (Theta)

If you are a options buyer, time is your biggest enemy. The premium of the options goes down by each passing day.

Never carry the position to the last week of expiry as premium’s value erode exponentially

#2 You May Loose Your Entire Capital

Yes , that is correct. You may loose your entire amount you put in the trade.

Suppose you bought nifty December 14000 Call Options and if nifty closes below 14000 (Or even at 14000) you will loose entire amount.

#3 Always Trade In Liquid Counters

I suggest to consider only Nifty and Bank Nifty Options trading in the beginning before venturing in to stock Options.

Many a times it happens in Stock Options that, you bought the options and when you wish to exit the trade you find that there is no buyers, or spread between bid and ask price is too steep.

In stocks, you can consider Reliance, SBI and Infosys Options.

#4 Choose a Discount Broker To Trade In Options

There are two types of brokers in India namely, Full Service brokers and discount brokers.

Full Service brokers charge on per lot basis and discount brokers charge fixed brokerage per trade irrespective of number of lots.

For example, Sharekhan which is Full service broker charge Rs100 per lot. Hence if you trade 10 lots of nifty, total brokerage will be Rs1000 for buy and Rs 1000 for Sell. (Hence total Rs 2000)

On the other hand, discount brokers such as Zerodha and Upstox charge fixed Rs 20/trade. So total brokerage with them would be Rs 40 for the same trade.

So for the Options traders, discount brokers are best suited as they will help in reducing the brokerage burden and indirectly increase profitability.

Read : 10 Best Discount Stock Brokers of India and their Brokerage Charges

Benefits of Options Trading

Options Trading if traded properly has lots of advantages. If one can predict the direction of the underlying correctly, Options can give huge profit with small downside risk.

- Leverage : With Options, one can buy higher number of shares with lesser amount (Premium). For example, you can buy 600 shares (1 lot) of Infosys at just Rs 9270. This is because, premium of 1200CE is trading at 16.2.

- Hedging : I use Options for hedging purpose. If I am long on Nifty Futures, I buy put Options to avoid any blackswan events that may result in huge gap down opening next day.

- Covered Options Trade: If an Investor hold securities for long term, he can sell out of the money call options and have regular extra income.

- Tax Efficient : When compared to Futures, Options are tax efficient. Since the tax is paid only on premium and not on total traded value, total tax out go is lesser.

Options Trading In India – Final Thoughts

Options involves leverage which is a double edged sword. If used properly, one can make enormous amount of money.

If you are entering with intention of making quick money, chances of blowing up your account is also high with options trading.

Trading Options in India picked up momentum during Corona lock down period. Many newcomers got attracted to options selling watching the fancy lifestyles of Options traders in social media.

Selling Options requires huge margin which they lacked and also adjusting the trade if it goes against you need further margin.

They suffered huge losses and it is all because they did not know how to trade options in India.

So before starting trading in Options, first learn the basics of Options. Once understood, start small since chances of doing mistakes are high in the beginning.

Once you gain the confidence and become profitable consistently, you can increase your bet.

Nevertheless, as explained earlier never let the broker’s issues (Server down, platform hanging etc) affect your trade. Always trade with leader in the business,